Pedigree Software, Population Genetics & GEDCOM Conversion Software

Tenset pedigree software products help breeders of cats, dogs and other animals efficiently manage breeding records and print wonderful pedigree certificates. The Extended Edition Edition of Breeders Assistant includes genetic diversity analysis - e.g. to plan matings by minimizing inbreeding or mean kinship, to bulk compute inbreeding and other measures of genetic diversity, and the means to analyse the contributions of founders to the breeding pool.

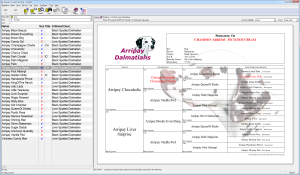

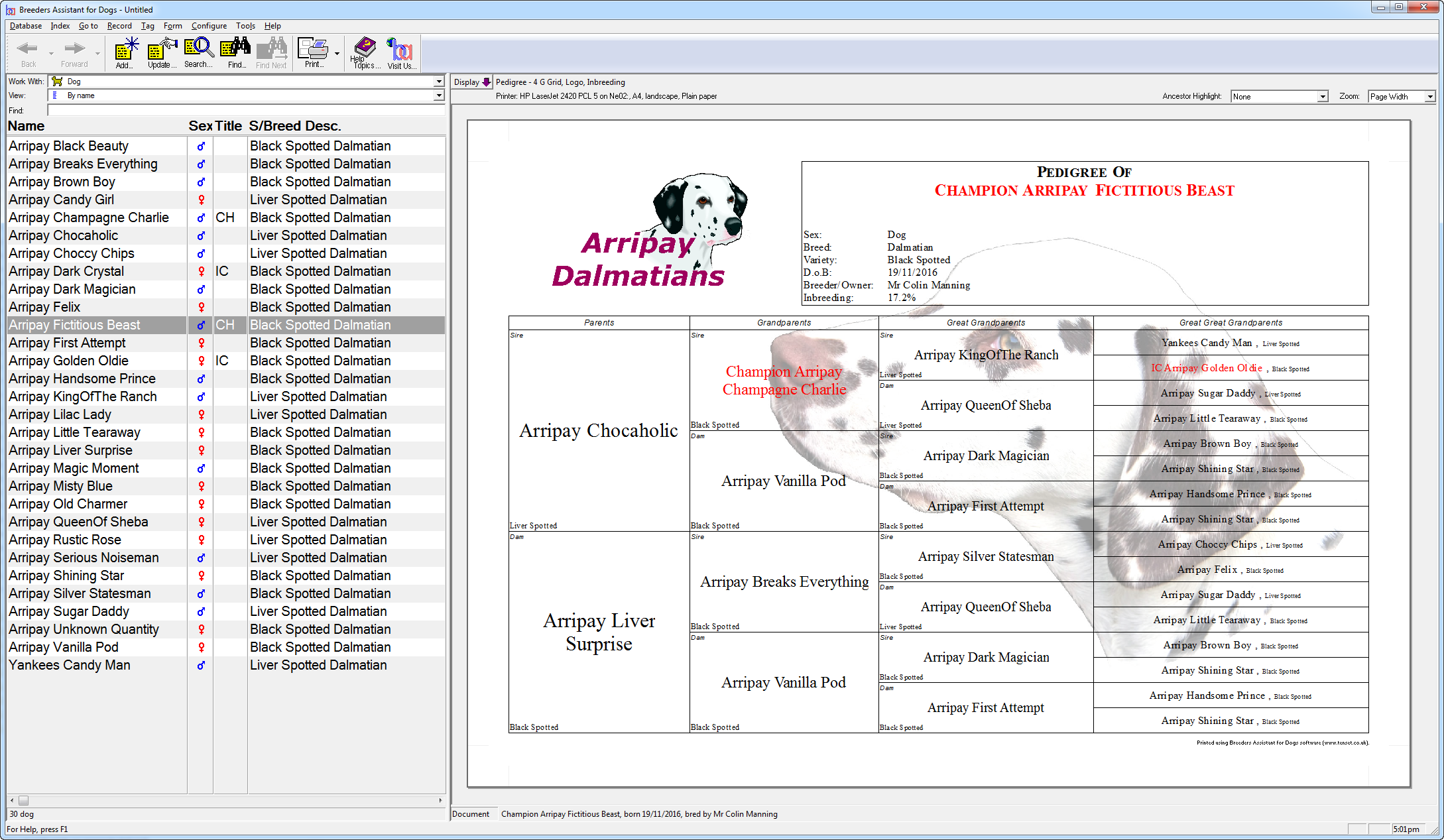

Breeders Assistant

Breeders Assistant is an animal record keeping, genetics analysis and pedigree software application for Windows 11/10.

It includes highly customizable pedigree certificates, detailed record keeping & features for kennel/cattery management.

The Extended Edition also includes advanced genetics analysis tools such as the ability to select prospective matings to minimize inbreeding and to maximize genetic diversity or the influence of important ancestors/individuals, and to compute measures of genetic diversity such as mean kinships and founder metrics.

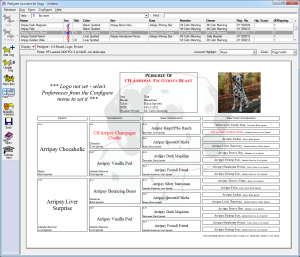

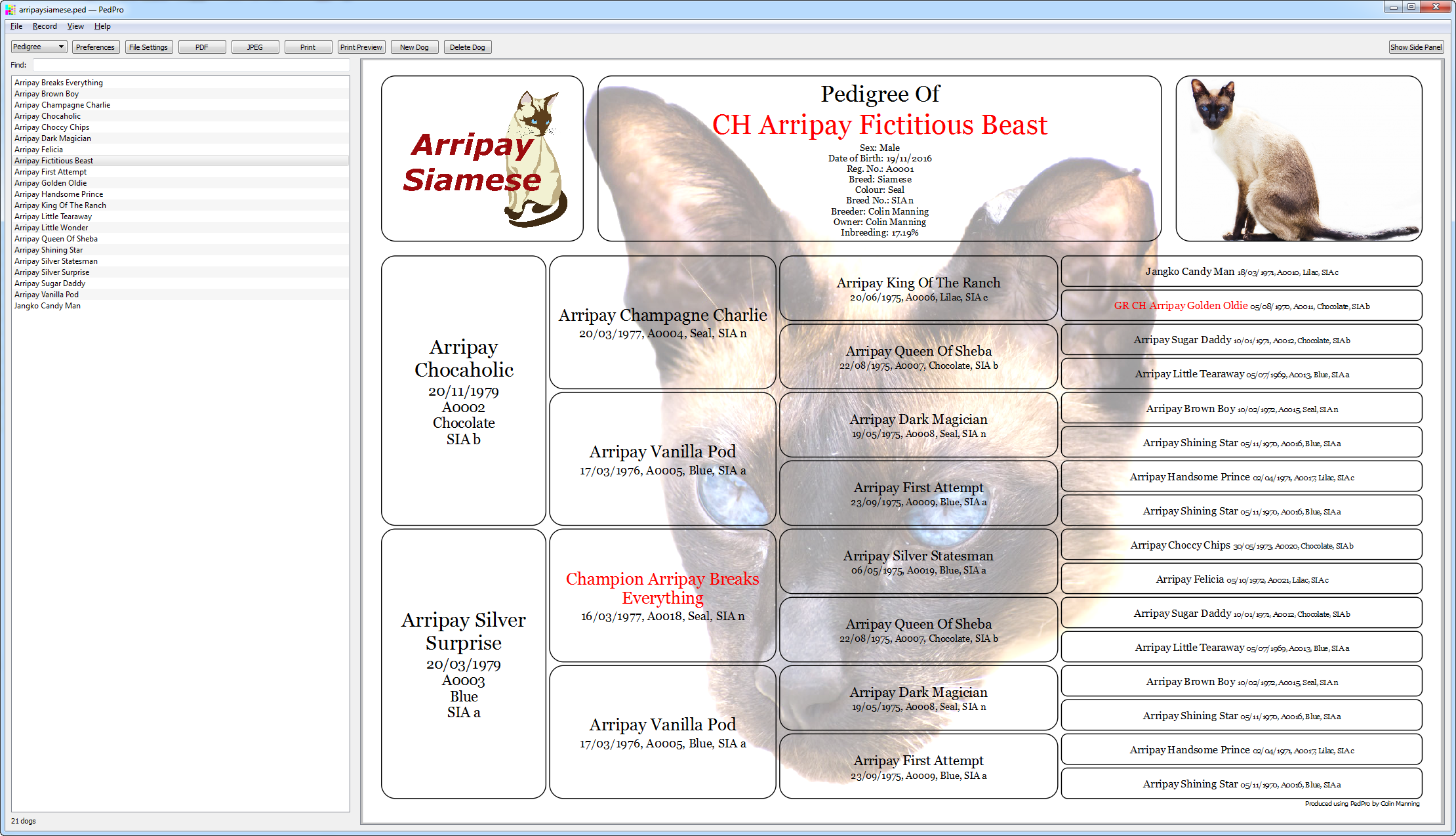

PedPro

PedPro is a pedigree program for your Windows-based computer that prints your pedigrees and stores your breeding records.

It offers you a straightforward pedigree template layout which you can fill in and then print or save to PDF.

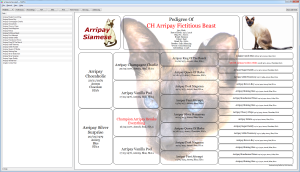

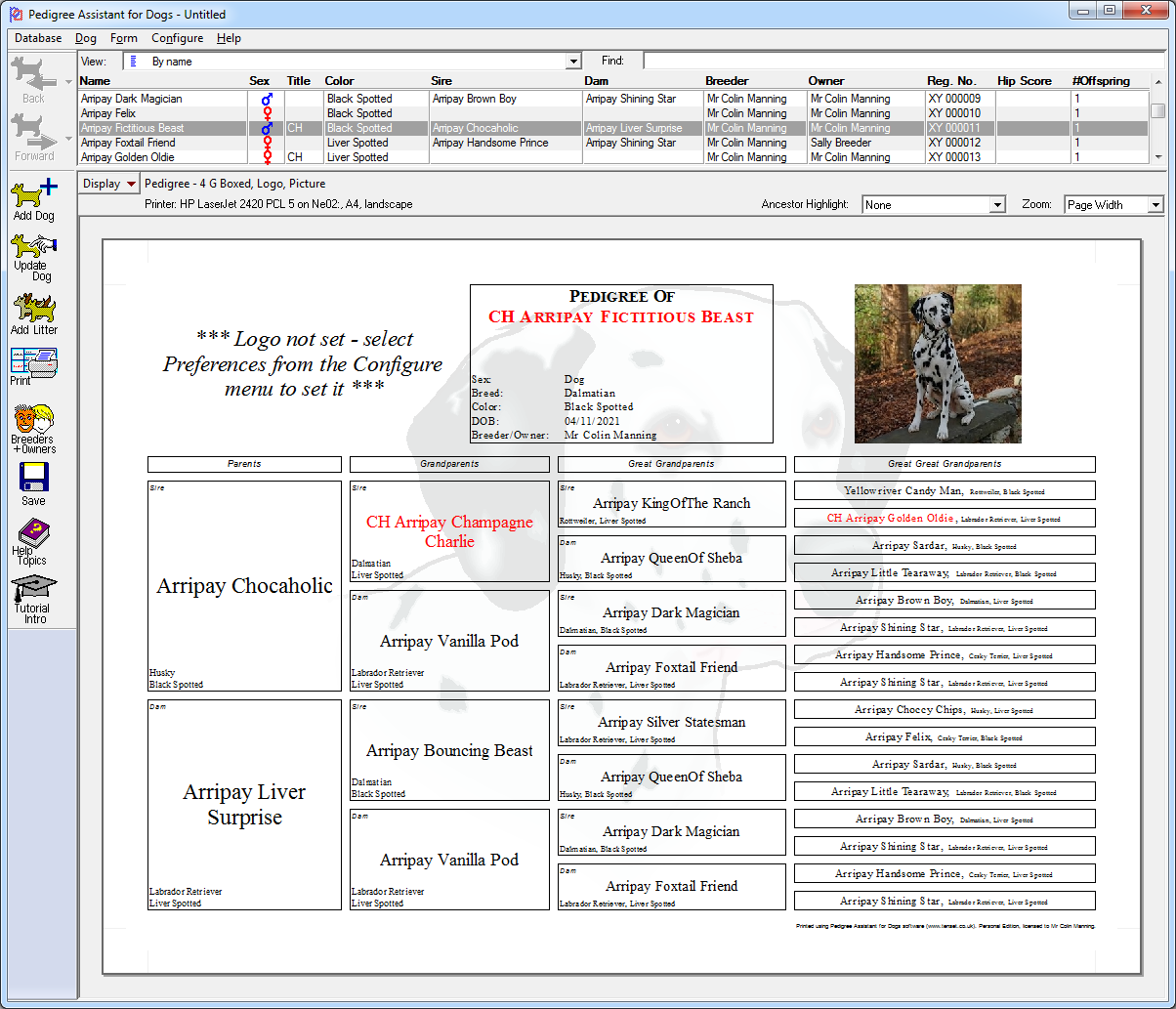

Pedigree Assistant

Pedigree Assistant is a sister pedigree software product to Breeders Assistant that generates similar printed pedigrees but without many of the other lesser used features.

Ideal if you just need a very good pedigree maker but little else.

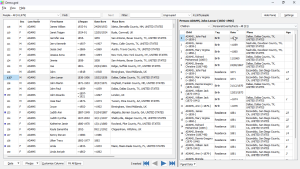

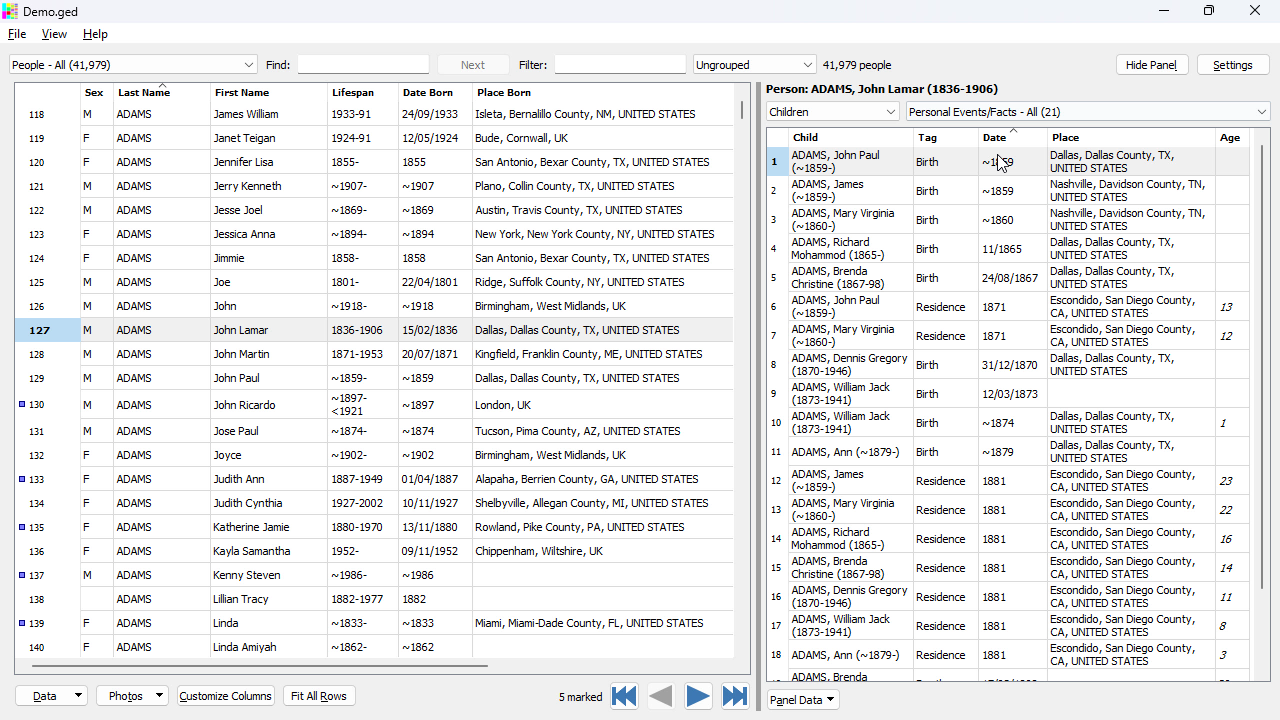

GedWiz

GedWiz is software to view, search and extract (export) data from GEDCOM files.

With GedWiz you can browse the data within a GEDCOM file as a series of tables including people, families, events etc., export data to CSV files (e.g. for import to Excel), and generate individual, ancestor and descendant reports in both text and PDF format.